Published: 22 May 2022 | Author: James Beresford

Do any of these BI Challenges sound familiar? Does your business run on high risk, ungoverned spreadsheets that nobody apart from their original creator really understands? (Boldly assuming they are still with your organisation). Do you frequently clash with your peers over who has the right version of the numbers? Is there a team of analysts and number crunchers beavering away to produce figures each month? Is that team duplicating effort by other departments? Do you even know if they might be? Do your peers readily share their data?

All these issues are common throughout modern businesses despite the means of eliminating them being readily available. There are of course huge benefits to be obtained by becoming a data driven organisation which is why many industries invest significantly in being able to use their information to improve their business.

Benefits of being Data Driven

Getting its house in good order and overcoming these BI Challenges allows an organisation to quickly realise the benefit of simply having reporting happen automatically, instead of being a panicked, last-minute activity for already overburdened analysts. This frees up the analytical capability of the business to use analysts to add greater value by identifying the opportunities and risks that data can reveal.

Leaders then can realise the benefits of having a 360-degree view of the organisation – from sales through to productivity – and change the track of business in real time, instead of waiting for a report with data from the last quarter and trying to correlate that with others in a mental juggling act. Finally, the improved window on data quality allows the data to be improved to the point where it can support automation within the business – another key pillar for Efficient Decision Making. Leaders are often uncertain of how to quantify the benefits from undertaking these often-challenging activities, but if you simply look around, the Financial Services sector is a heavy investor in this space, and let’s face it, banks aren’t going to be investing if there isn’t a good ROI.

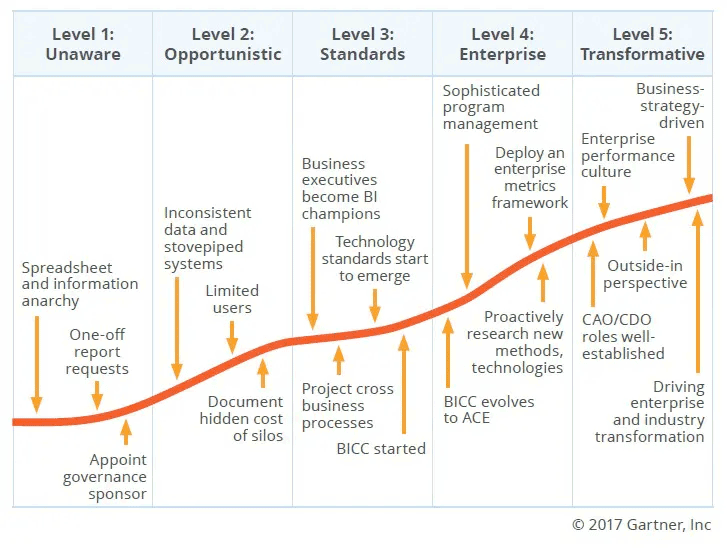

Data and analytics veterans often express a degree of frustration that we are still trying to solve the same problems we were decades ago. However, most of us have come to accept this is how businesses grow and mature in their information usage. Some of these steps are virtually inevitable as an organisation grows in capability, complexity, and capacity. Gartner’s Information Management Maturity Model has been in existence for 20 years describing exactly this journey

Gartner Information Management Maturity Model

There are few shortcuts to solving these BI Challenges, but the difficulty level has been decreased in recent years. So, what has changed to make these problems more solvable? Simply, the evolution of user friendly, cloud based, pay by usage data & analytics technologies has massively lowered the barriers to entry. The ability to start an enterprise grade journey has stopped being an expensive up-front expenditure and is now – in theory – something any organisation can do.

This is an excerpt from our Enterprise PowerBI Whitepaper – please follow the link to read all the content – it’s free & there’s no sign up required.

At Talos we have defined our PEBBLE Enterprise PowerBI Methodology to help organisations drive success in deploying PowerBI as a complete self service analytics platform. If you are struggling with any of the challenges discussed above, we might be able to help. Please get in touch if you’d like to have a discussion.

Cheers, James

Get the latest Talos Newsletter delivered directly to your inbox

Automation & Analytics Technologies for Business

Talos helps organisations build modern data and analytics platforms using Databricks, Microsoft Fabric and Power BI. We work from strategy through implementation, ensuring you get value from the platform without unnecessary complexity.

Australian councils face backlogs, staff turnover, and rising community expectations. We help you improve service delivery and operational efficiency through process automation — integrated with TechnologyOne, Civica, and Pathway.

Talos helps organisations build reporting solutions using Jet Analytics